irs child tax credit 2021

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The maximum Child Tax Credit increased to 3600 for children under the age of 6 and to 3000 per child for children between ages 6 and 17.

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower.

. The IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit to parents of children up to age five. Advance payments of the 2021 Child Tax Credit will be made regularly from July through December to eligible taxpayers who have a main home in the United States for more than half the. The IRS pre-paid half the total credit amount in monthly payments from July to December 2021.

Starting on July 15th through December families can get monthly Child Tax Credit payments of 250 per child between 6-17 or 300 per child under 6. The child tax credit for the 2021 tax year is bigger and better than ever when compared to 2020. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17.

Originally started by John Dundon an Enrolled Agent who represents people against the IRS rIRS has grown into an excellent portal for quality information from any. Child Tax Credit 2021. The 2021 child tax credit changes are complicated and dont help everyone.

E-File Directly to the IRS. June 21st 2021 ChildTaxCredit Awareness Day. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. 3000 for qualifying children between age 6 to 17 years old. 602 Child and Dependent Care Credit IRS.

The Child Tax Credit CTC for 2021 is fully refundable if you or your spouse if filing a joint return have a principal place of abode in the United States for more than half of 2021. The American Rescue Plan Act of 2021 increased the amount of the CTC for the 2021 tax year only for most taxpayers. Tax Benefits for Education.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. The credit amount was significantly increased and the title loans Michigan IRS made monthly advance payments to qualifying families from. Ad Home of the Free Federal Tax Return.

3600 for qualifying children age 5 and under. Parents income matters too. A childs age determines the amount.

Have been a US. Families will receive the entire 2021 Child Tax Credit that they are. These expanded increased and refundable tax breaks apply for the 2021 tax year and an individual or household can claim both.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS. The Child and Dependent Care Tax Credit CDCTC.

The increased amounts are reduced phased out for modified adjusted gross income. Temporary Expansion for 2021 Under the American Rescue Plan Act of 2021 Page 2. Fully refundable means that you can benefit from the maximum credit even if you do not have earned income or do not owe any Federal income tax.

That comes out to 300 per month through the end of 2021 and. The credit amounts will increase for many taxpayers. It also made the parents or guardians of 17-year-old children newly eligible for up to the full 3000.

But because the IRS is using 2020 or 2019 tax returns to determine eligibility the tax agency wont know about children born in 2021. Child and Dependent Care Expenses Page 12. For 2021 the credit amount is.

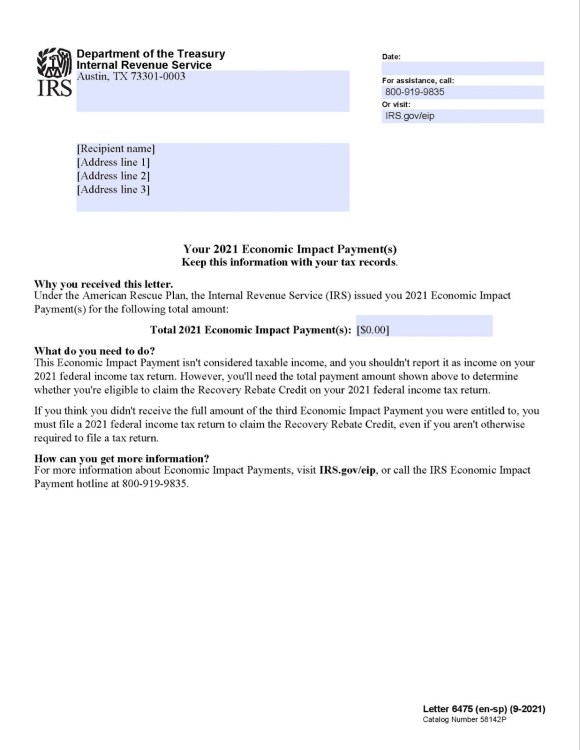

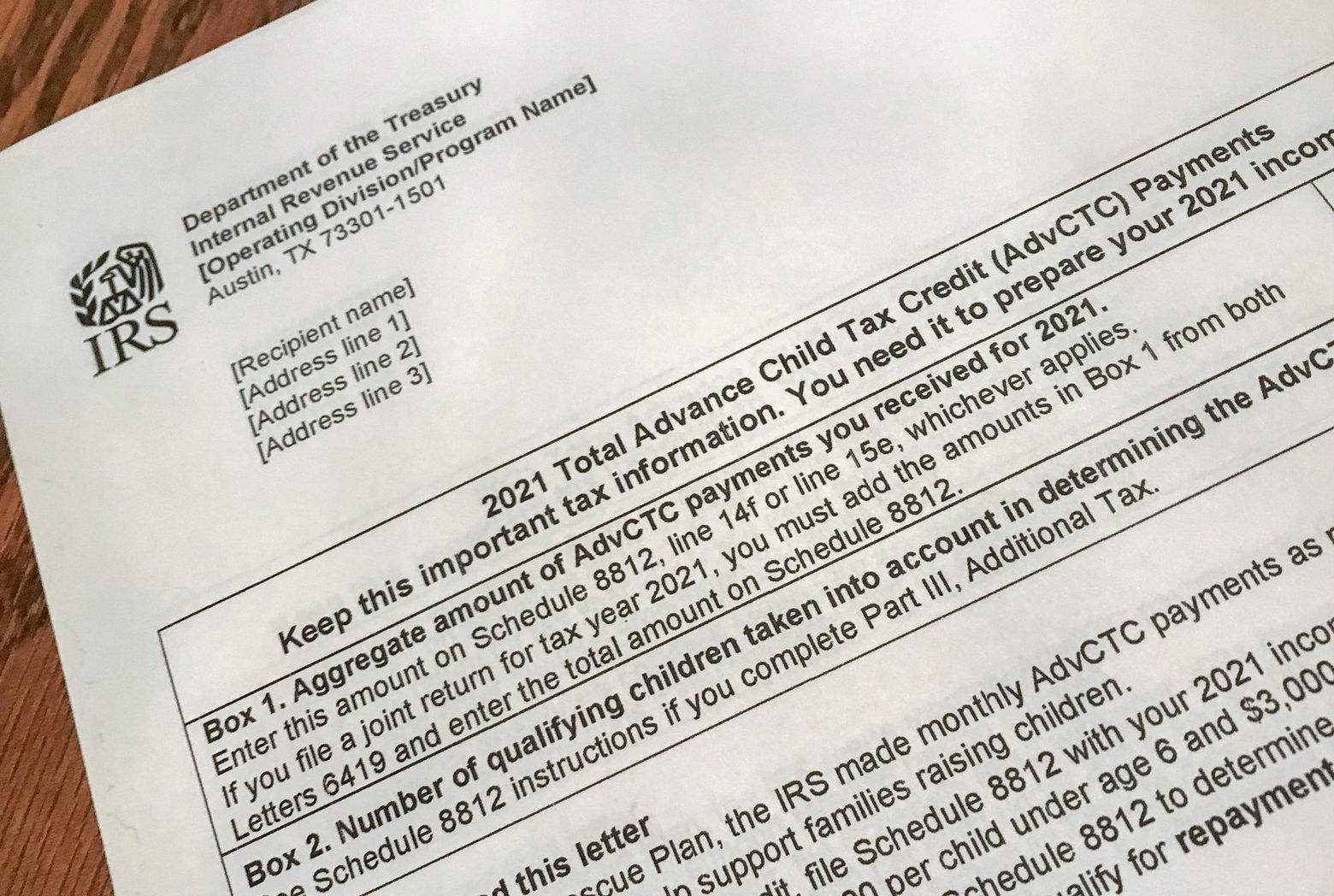

Families Who Got The Child Tax Credit Need To Look Out For This Letter

How To Call The Irs With Tax Return And Child Tax Credit Questions Cnet

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit What To Do If You Didn T Receive A Letter 6419 Marca

Will The Child Tax Credit Affect My 2021 Tax Return

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

Ben Has Your Back Explaining Recent Irs Letters About The Child Tax Credit

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

Tax Season 2022 Tips For A Speedy Refund And How To Avoid Gumming Up The Works The Seattle Times

Irs Warns Of Child Tax Credit Scams Abc News

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time